"Exploring Your Health Insurance Options: Types and Benefits"

- Swamini services

- Nov 3, 2023

- 2 min read

Selecting the best type of health insurance is a pivotal decision that hinges on your unique needs, preferences, and financial circumstances. The world of health insurance offers a plenty of options, each with its own benefits. To navigate this complex terrain, consider the following factors when determining the optimal health insurance plan:

1. Assess Your Needs:

Begin by conducting a comprehensive assessment of your healthcare needs. Consider your current health status, any pre-existing conditions, anticipated medical expenses, and any special healthcare requirements. This self-examination forms the foundation for selecting the most suitable plan.

2. Types of Health Insurance:

Health insurance comes in various enigmatic forms:

a. Health Maintenance Organization (HMO): HMO plans often demand the choice of a primary care physician (PCP) and mandate referrals for specialist consultations. They usually have lower premiums but require in-network care.

b. Preferred Provider Organization (PPO): PPO plans provide greater freedom to choose healthcare providers, both in and out of the network. This flexibility comes at a higher premium cost.

c. High Deductible Health Plan (HDHP): HDHPs are characterized by lower premiums but higher deductibles. They are ideal for those who are comfortable with higher out-of-pocket costs and want to save on monthly premiums.

d. Exclusive Provider Organization (EPO): EPO plans require in-network care and do not provide coverage for out-of-network services. They strike a balance between HMOs and PPOs in terms of cost and flexibility.

3. Network Considerations:

The selection of an in-network or out-of-network provider can be an intricate decision. Staying within the network is typically more cost-effective, as insurance companies have negotiated reduced rates with in-network healthcare providers. However, if you have a preferred doctor or specialist who is out of network, this might influence your choice.

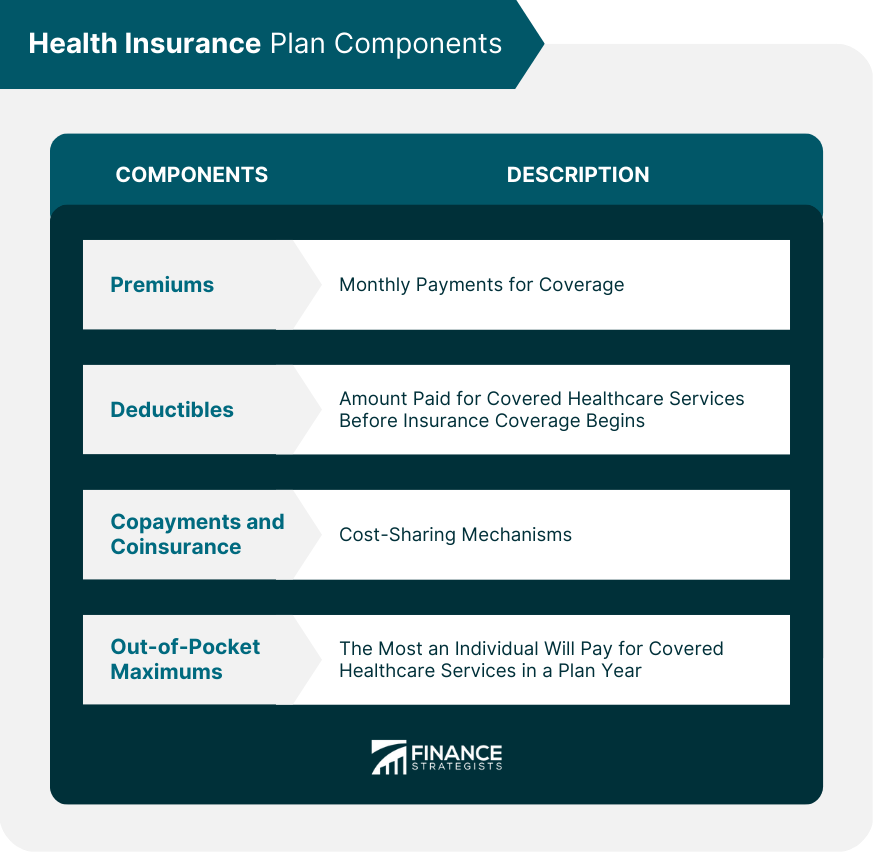

4. Premiums and Deductibles:

Premiums are the recurring payments you make for your health insurance. Higher premiums are often associated with lower deductibles and vice versa. Evaluate your budget and risk tolerance to determine the right balance between premiums and deductibles.

5. Additional Benefits:

Some health insurance plans offer supplemental benefits like dental, vision, or mental health coverage. Consider whether these extras align with your healthcare needs and whether they justify the additional cost.

6. Annual and Lifetime Limits:

Examine the plan's annual and lifetime limits on coverage. These limits can affect your financial protection in the event of major health issues, so it's essential to understand them.

7. Out-of-Pocket Costs:

In addition to premiums and deductibles, evaluate copayments, coinsurance, and out-of-pocket maximums. These factors influence how much you'll pay for healthcare services once your coverage kicks in.

8. Evaluate Exclusions and Coverage Details:

Thoroughly scrutinize the plan's coverage details and any exclusions. Ensure that essential services and treatments are covered, especially if you have specific healthcare needs.

9. Consider Prescription Drug Coverage:

If you require regular medications, assess the plan's prescription drug coverage. Some plans may offer different tiers of coverage, affecting your out-of-pocket expenses for medications.

Conclusion:

Navigating the labyrinth of health insurance can be daunting. It's often beneficial to seek advice from a qualified insurance professional who can help you make an informed decision tailored to your specific situation.

Ultimately, the best type of health insurance for you is the one that aligns with your healthcare requirements, budget, and personal preferences. Make a deliberate choice, as health insurance is a pivotal component of your financial and physical well-being.

Comments